The benefits of a 529 account can help make your child's future brighter

Opening a 529 college savings account can be a smart way to save for your child's higher education.

The tax advantages, low fees and flexibility of our Bright Start 529 account allows you to support your child's dreams for their future. Plus, you can easily invite family and friends to join the savings journey with Ugift®.

Remember: Every dollar saved today may be one less dollar borrowed in the future.

Triple tax advantages can help both you and your child

You could save more with a Bright Start 529 account. Get tax-deferred growth and 100% tax-free withdrawals on qualified expenses. Plus, you may qualify for a state tax deduction up to $20,000 per beneficiary per year for married/joint filers for contributions made into a Bright Start 529 account.

Limitations apply.1

How to maintain more of your potential growth

This chart illustrates the hypothetical growth of an initial $2,000 investment and a monthly $200 contribution over 18 years in a taxable account vs. a tax-deferred account, assuming a 7.69% annual return. Based on past performance and does not predict or guarantee future results. Click here for chart assumptions.

Taxable account at 18 Years Total: $77,825.81

100% tax-deferred account at 18 Years Total: $97,570.78

- Amount of taxes that could be saved: $19,744.97

Read about material differences between taxable investments and tax-deferred investments.

You have options for how you save and use your savings

Low fees

A Bright Start 529 plan has some of the lowest fees of 529 plans in the nation. That could mean more money toward your savings.2

Flexibility

Use savings for qualified education costs at eligible institutions in the U.S. or abroad—including tuition, housing, books and more. Unused funds never expire and can be used at a later time, or they can be transferred to an eligible family member or a Roth IRA (subject to rollover rules and limits).3

Investment options

Our experienced investment team provides access to diverse investment options to align with your investment strategy and preferred level of involvement all while keeping costs low.

Read more about investment options.

Strategic savings

Saving for education can feel overwhelming, but we're here to help. See how your contributions can add up with our tools designed to track your progress and highlight the impact of compound growth.

Learn how our 529 works.

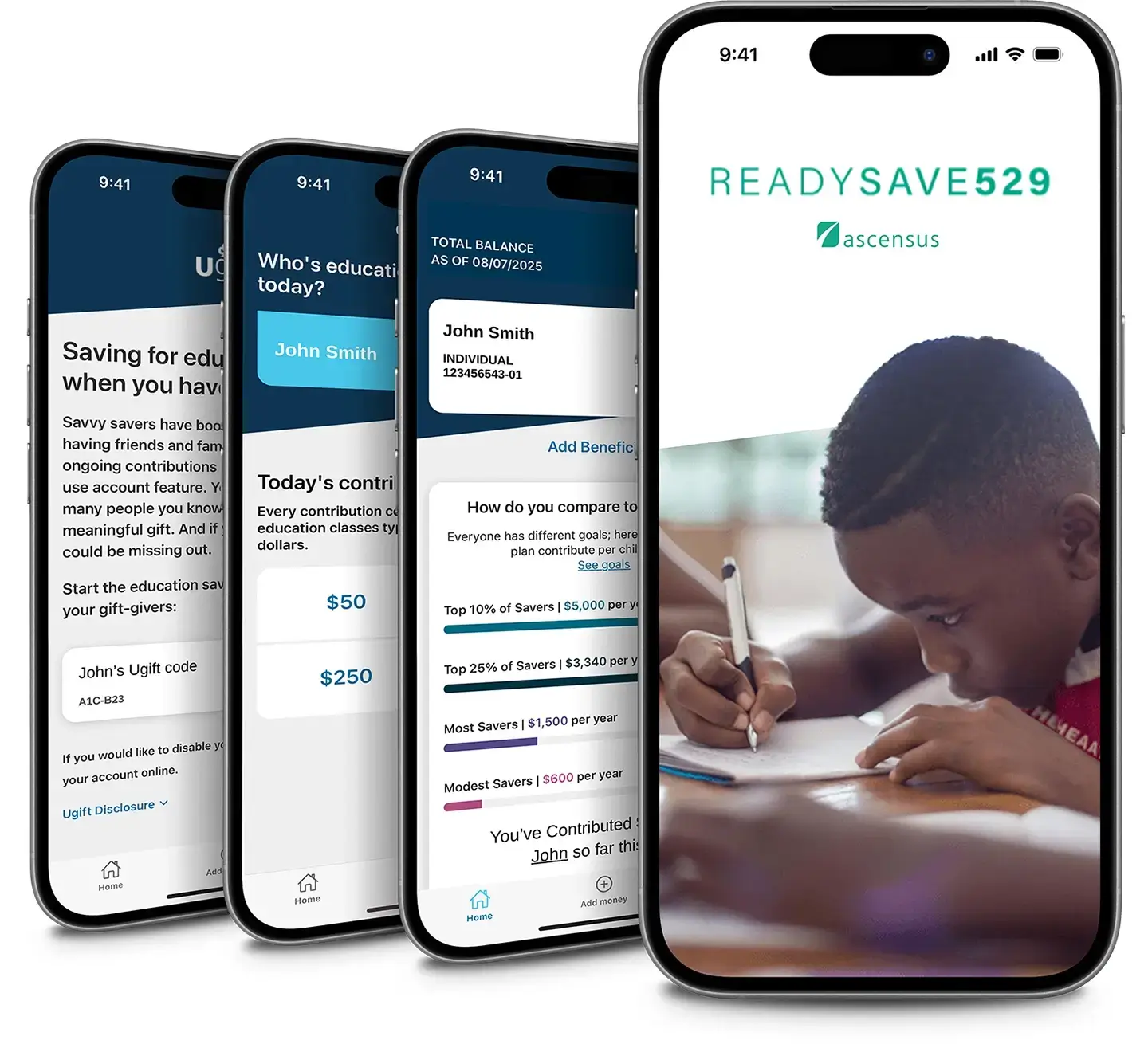

Keep track of your education savings on the go

Open and manage your 529 account with the ReadySave™ 529 app.

- Monitor your savings progress and track your goals

- Check your account balance or investment allocations

- Easily make one-time or recurring contributions

- Invite family and friends to contribute with Ugift®

- Withdrawal funds for certain situations

Have more questions about Bright Start 529 benefits?

If your child ends up not needing the funds for college, you always have multiple options for your money:

- Your funds can be used to pay for a variety of eligible education expenses, including public or private colleges, universities, community colleges, professional and vocational schools, certain apprenticeship expenses or postgraduate programs in the United States—and even some schools abroad.1

- Your 529 can be used for student loan repayment up to a $10,000 lifetime limit per individual.1

- Effective July 5, 2025, you can use funds for postsecondary credentialing expenses1

- You can use up to $20,000 annually toward K-12 expenses (per student).1

- You can transfer the funds to another eligible beneficiary, such as another child, a grandchild or yourself.

- If you just want the money back, you can withdraw the funds at any time. If funds are withdrawn for a purpose other than qualified higher education expenses, the earnings portion of the withdrawal is subject to federal and state taxes plus a 10% additional federal tax on earnings (known as the “Additional Tax”). See the Plan Description for more information and exceptions.

- You can rollover funds to a Roth IRA. Limitations apply.2

- Or you can always wait because the funds never expire, and often the choice to go to school is a delayed decision. So if your child changes their mind down the road, your savings will still be available.

Footnotes

- 1Withdrawals for Postsecondary Credentialing Expenses and K-12 Expenses can be withdrawn free from federal tax. For Illinois taxpayers, these withdrawals may include recapture of tax deduction, state income taxes well as penalties. Withdrawals for registered apprenticeship programs and student loans can be withdrawn free from federal and Illinois income tax. If you are not an Illinois taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

- 2For Illinois tax purposes, rollovers are permitted from an account to a Roth IRA without incurring federal and state income tax or penalties. State tax treatment of a rollover from a 529 plan into a Roth IRA is determined by the state where you file state income tax. There are conditions that must be met, including the 529 plan must have been in existence for at least 15 years.

You should talk to a qualified professional about how tax provisions affect your circumstances.↩

Your contributions will always be yours, and you do not need to be a resident of Illinois to open, contribute to or use a Bright Start 529 account. Your account can also be used for a range of qualified expenses in state, out of state and abroad. If you move to another state, you can keep your money invested and continue making contributions to your Bright Start 529 account—no problem!

Assets in a parent-owned 529 account have less of an impact on financial aid than some other savings methods. The Student Aid Index (SAI), formally known as Expected Family Contribution (EFC), calculations for financial aid generally factor parent assets outside of retirement savings at approximately 5%, whereas student assets are generally factored in at 20% or more. Therefore, a parent-owned 529 account may have less of an impact on financial aid eligibility than assets owned by the student.1

Footnotes

- 1The treatment of investments in a 529 savings plan varies by school. Assets are typically treated as the account holder’s and not the student’s. (Student assets are generally assessed at 20%, whereas parental assets are generally assessed at 5.6%.) Any investments, including those in 529 accounts, may affect the student’s eligibility to get financial aid based on need. You should check with the schools you are considering regarding this issue.↩

An Illinois state plan has been the preferred choice for thousands of families for more than 25 years. With an established history, more than 345,700 Bright Start 529 accounts have been opened allowing families to save more than $12.5 billion toward education.1 The Illinois State Treasurer's Office selected TIAA-CREF Tuition Financing, Inc. (TFI) as the Plan Manager.

- 1Based on statistics provided as of 12/31/2025.↩