Illinois Taxpayer Guide

Preparing taxes can be confusing. Below, you'll find easy access to common questions from Illinois taxpayers. Please consult with your legal or tax professional for tax advice based on your own circumstances.

Additional Questions?

Read our FAQsMost popular topics

Illinois taxpayers can reduce their state taxable income up to $20,000 if married filing jointly ($10,000 filing single) for contributions made into Bright Start 529.

An individual who files an individual Illinois state income tax return will be able to deduct up to $10,000 per tax year (up to $20,000 for married taxpayers filing a joint Illinois state income tax return) for their total, combined contributions to the Bright Start Direct-Sold College Savings Program, the Bright Directions Advisor-Guided 529 College Savings Program and College Illinois! during that tax year. The $10,000 (individual) and $20,000 (joint) limit on deductions will apply to total contributions made without regard to whether the contributions are made to a single account or more than one account. The amount of any deduction previously taken for Illinois income tax purposes is added back to Illinois taxable income in the event an account owner makes an Illinois nonqualified withdrawal from an account. You should consult with your financial, tax or other advisor regarding your individual situation.

The deadline for contributions is December 31.

Taxpayers report contributions to their Bright Start 529 account on the Illinois 1040 Tax Form, Schedule M (see below for example). You will need to do this for each beneficiary.

Follow these steps when filing your Illinois 1040 Tax Form, Schedule M:

- Locate your Bright Start 529 statements dated December 31 for each beneficiary. To view them, log in to your online account portal at BrightStart.com, then go to "View profile and documents" and select "Statements, Confirms, and Tax Forms."

- After selecting "Statements, Confirms, and Tax Forms," a drop-down menu appears.

- Year: Select the applicable tax year

- Beneficiary: Select All Beneficiaries

- Document Type: Select Statements

- View/Save/Print all Statements with the date 12/31

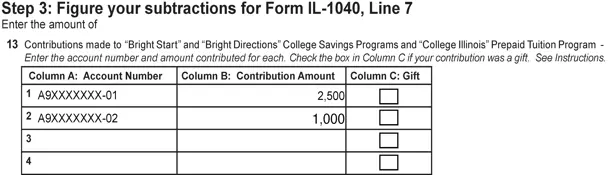

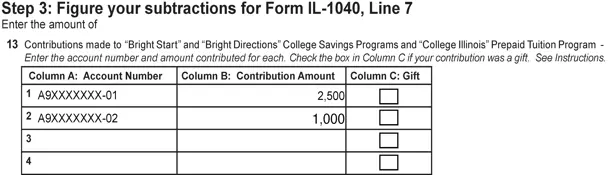

Below is an example of a Bright Start 529 account that includes contributions to two Bright Start 529 accounts.

For each Bright Start 529 account, you can claim contributions on the Illinois Tax Form 1040, Schedule M by entering the information as shown in the below example.

Reminder: When entering contribution totals on the Illinois Tax Form 1040, Schedule M, it's important to exclude any gift contributions that were contributed to the Bright Start 529 account by individuals other than the taxpayer. You should also exclude any prior year contributions that may have been received in the applicable tax year and, if you completed a rollover into Bright Start 529, to exclude the earnings portion.

Please note: Reporting this information incorrectly could result in a delay in processing your Illinois state tax return.

Note: Illustration was completed using the 2025 Individual Income Tax Forms provided on the Illinois Department of Revenue website. If the form has changed, the references to specific sections or lines could be incorrect.

Your prior year contribution information can be found on your December 31 account statement. Contributions are reported on a cash basis so if you made any contributions online at the end of December or by mail with a late December postmark you will want to see if they were included in the transaction activity on your December 31 statement or if we received them and posted them in January as a "Prior Year" contribution. A postmarked contribution invested in January as a "Prior Year" contribution should be eligible for the prior year Illinois tax deduction. Likewise, review your 1st quarter account statement for any "Prior Year" contributions that you would need to adjust for.

The Illinois Department of Revenue has stated (in a nonbinding general information letter) that the state income tax deduction is available to Illinois taxpayers other than the Account Owner who contribute to an Account. Please review your records to match your total contributions. Contributions received through Ugift will be segregated on account statements. The year-to-date contribution amount on the statement could include other contributions to your account by non-account owners, such as contributions made by personal check from other family members or friends (those generally would be deductible by the contributor versus you). Also, keep in mind only the basis or contribution portion of an out-of-state rollover is deductible (the earnings portion cannot be deducted).

If you take a withdrawal from your Bright Start 529 sometime during the tax year, you will likely receive a 1099-Q for any withdrawals made the previous year. The 1099-Q includes the total of all withdrawals you make during a given year, some of which may be taxable depending on the withdrawal type.

See question "How to review account statements, activity online and tax reports" for instructions on how to view your 1099-Qs online and/or when you will receive a 1099.

Bright Start 529 gifting is completed through Ugift. By creating an account at ugift529.com, you can view your gift history and total amount of gifts given to each account for the current calendar year.

Additional Questions?

Read our FAQsAll Taxpayer FAQs

Illinois Tax Deduction

Illinois taxpayers can reduce their state taxable income up to $20,000 if married filing jointly ($10,000 filing single) for contributions made into Bright Start 529.

An individual who files an individual Illinois state income tax return will be able to deduct up to $10,000 per tax year (up to $20,000 for married taxpayers filing a joint Illinois state income tax return) for their total, combined contributions to the Bright Start Direct-Sold College Savings Program, the Bright Directions Advisor-Guided 529 College Savings Program and College Illinois! during that tax year. The $10,000 (individual) and $20,000 (joint) limit on deductions will apply to total contributions made without regard to whether the contributions are made to a single account or more than one account. The amount of any deduction previously taken for Illinois income tax purposes is added back to Illinois taxable income in the event an account owner makes an Illinois nonqualified withdrawal from an account. You should consult with your financial, tax or other advisor regarding your individual situation.

The contribution, or basis, portion of a rollover from a non-Illinois 529 plan is eligible for the Illinois state income tax deduction, but not the earnings portion. For the rollover contribution to be considered for Illinois state income tax deduction purposes, the rollover check needs to be dated in the tax year it is taken and the envelope with the rollover check from your previous 529 plan needs to have a postmark from the year the deduction is taken. Please note, the eligibility for the state tax deduction is based on when Bright Start 529 receives the rollover check – not the completed rollover request form. To make this change free of federal taxes and penalties, the plan you're transferring funds from must have the same designated beneficiary or the beneficiary must be a qualifying family member of the current beneficiary. Please read the Bright Start 529 Plan Description for complete rollover information. Consult your tax professional.

See "How to roll over your balance from another 529 plan account" for information on how to complete a rollover.

The deadline for contributions is December 31.

Gift Contributions

The Illinois Department of Revenue has stated (in a nonbinding general information letter) that the state income tax deduction is available to Illinois Taxpayers other than the Account Owner who contribute to an Account.

Bright Start 529 gifting is completed through Ugift. By creating an account at ugift529.com, you can view your gift history and total amount of gifts given to each account for the current calendar year.

Contributions to the Plan are generally considered completed gifts for federal tax purposes and, therefore, are potentially subject to federal gift tax. If a contributor's contributions to an Account for a Beneficiary in a single year exceed the current annual gift tax exclusion amount, the contributor may elect to treat up to five (5) times the current annual gift tax exclusion amount as having been made ratably over a five-year period and any excess amount will be treated as a taxable gift for that year. Please read the Bright Start 529 Plan Description and talk to your financial advisor for more information about the Federal Gift Tax rules.

In Illinois, you may take the Illinois state income tax deduction only in the year that the contribution was made. The Illinois state income tax deduction does not carry forward to future years for an accelerated gift. Please consult your tax or financial professional for more information regarding a large gift and any tax considerations that should be considered.

If you made larger gifts don't forget to mention them to your tax professional so they can determine if any special IRS filings are required. (For current gifting limit, see section "Legacy and estate planning" on the Bright Start 529 gifting page.) If you took advantage of the special five-year, front-loading election allowed for 529 plans, please notify your tax professional so they can prepare any necessary Gift Tax Return. The due date for filing is April 15.

Filing your Illinois Taxes

Taxpayers report contributions to their Bright Start 529 account on the Illinois 1040 Tax Form, Schedule M (see below for example). You will need to do this for each beneficiary.

Follow these steps when filing your Illinois 1040 Tax Form, Schedule M:

- Locate your Bright Start 529 statements dated December 31 for each beneficiary. To view them, log in to your online account portal at BrightStart.com, then go to "View profile and documents" and select "Statements, Confirms, and Tax Forms."

- After selecting "Statements, Confirms, and Tax Forms," a drop-down menu appears.

- Year: Select the applicable tax year

- Beneficiary: Select All Beneficiaries

- Document Type: Select Statements

- View/Save/Print all Statements with the date 12/31

Below is an example of a Bright Start 529 account that includes contributions to two Bright Start 529 accounts.

For each Bright Start 529 account, you can claim contributions on the Illinois Tax Form 1040, Schedule M by entering the information as shown in the below example.

Reminder: When entering contribution totals on the Illinois Tax Form 1040, Schedule M, it's important to exclude any gift contributions that were contributed to the Bright Start 529 account by individuals other than the taxpayer. You should also exclude any prior year contributions that may have been received in the applicable tax year and, if you completed a rollover into Bright Start 529, to exclude the earnings portion.

Please note: Reporting this information incorrectly could result in a delay in processing your Illinois state tax return.

Note: Illustration was completed using the 2025 Individual Income Tax Forms provided on the Illinois Department of Revenue website. If the form has changed, the references to specific sections or lines could be incorrect.

Your prior year contribution information can be found on your December 31 account statement. Contributions are reported on a cash basis so if you made any contributions online at the end of December or by mail with a late December postmark you will want to see if they were included in the transaction activity on your December 31 statement or if we received them and posted them in January as a "Prior Year" contribution. A postmarked contribution invested in January as a "Prior Year" contribution should be eligible for the prior year Illinois tax deduction. Likewise, review your 1st quarter account statement for any "Prior Year" contributions that you would need to adjust for.

The Illinois Department of Revenue has stated (in a nonbinding general information letter) that the state income tax deduction is available to Illinois taxpayers other than the Account Owner who contribute to an Account. Please review your records to match your total contributions. Contributions received through Ugift will be segregated on account statements. The year-to-date contribution amount on the statement could include other contributions to your account by non-account owners, such as contributions made by personal check from other family members or friends (those generally would be deductible by the contributor versus you). Also, keep in mind only the basis or contribution portion of an out-of-state rollover is deductible (the earnings portion cannot be deducted).

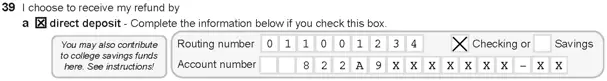

If you file Illinois income taxes and you receive an Illinois income tax refund, you can request to contribute your Illinois tax refund directly into one of your Bright Start 529 accounts. To do so, follow these three steps at the bottom of your IL-1040 Form:

- Routing number: provide the Bright Start 529 routing number 011001234

- Account type: select Checking

- Account number: use prefix 822 + your 11-digit Bright Start 529 account number. This includes the 9-alphanumeric characters + 2-digit extension (e.g. A12345678-01)

See Summary below referencing Step 11, Line 39 on the IL-1040 Form

Note: The IL-1040 Form allows direct deposit to only one 529 account. It allows you to include the hyphen in the account number and does not require you to include leading or trailing zeroes.

Note: Illustration was completed using the 2025 Individual Income Tax Forms provided on the Illinois Department of Revenue website. If the form has changed, the references to specific sections or lines could be incorrect.

Withdrawals and Taxes

If you take a withdrawal from your Bright Start 529 sometime during the tax year, you will likely receive a 1099-Q for any withdrawals made the previous year. The 1099-Q includes the total of all withdrawals you make during a given year, some of which may be taxable depending on the withdrawal type.

See question "How to review account statements, activity online and tax reports" for instructions on how to view your 1099-Qs online and/or when you will receive a 1099.

When a withdrawal is made from a Bright Start 529 account, the tax-responsible party is determined by which party the withdrawal is payable to.

See question "How to review account statements, activity online and tax reports" for information on who the tax-responsible party is for withdrawals.

If you receive a refund from an Eligible Educational Institution for Qualified Higher Education Expenses ("QHEE") that were paid from money withdrawn from your Account:

- Recontribution of Refunded Amounts – you can recontribute the funds no later than 60 days after the date of the refund. Please note, it will not be subject to federal and possibly state income tax if it is recontributed to a qualified tuition program for the same Beneficiary not later than 60 days after the date of the refund.

- Other Qualified Higher Education Expenses – you may be able to use the funds to pay other Qualified Higher Education Expenses incurred by that Beneficiary in the same calendar year.

- Nonqualified Withdrawal – if you are not able to recontribute within 60 days or use the funds to pay for other QHEE, the funds may be treated as a Nonqualified Withdrawal or a Taxable Withdrawal (depending on the reason for the refund).

You should consult with your financial, tax or other advisor regarding your individual situation.

See "What are qualified higher education expenses?" in the FAQs.

See "What are qualified higher education expenses?" in the FAQs.

The part of a distribution representing the amount paid or contributed to a qualified tuition program doesn't have to be included as income. This is a return of the investment in the plan. The designated beneficiary generally doesn't have to include any earnings distributed from a qualified tuition program as income if the total distribution is less than or equal to adjusted qualified education expenses. To determine if your total distributions for the year are greater or less than the amount of qualified education expenses, you must compare the total of all qualified tuition program distributions for the tax year to the adjusted qualified education expenses. Adjusted qualified education expenses are the total qualified education expenses reduced by any tax-free educational assistance. Tax-free educational assistance includes: the tax-free portion of scholarships and fellowship grants; veterans' educational assistance; the tax-free portion of Pell grants; employer-provided educational assistance; and any other tax-free payments (other than gifts or inheritances) received as educational assistance.

For information on coordination with American Opportunity and Lifetime Learning credits; Coverdell Education Savings and Tuition and Fees deductions see "How do 529 plan tax benefits coordinate with Hope/American Opportunity or Lifetime Learning Tax Credits and other federal tax benefits for education" in the FAQs.

Additional Tax Resources

For more information on the federal and Illinois tax treatment of Bright Start 529, the Internal Revenue Service (IRS) and Illinois Department of Revenue (IDOR) have a wide variety of helpful instructions and publications with detailed information on the tax treatment of 529 plans and related educational credits.

IRS Resources:

- IRS

- IRS: Education credits - American Opportunity Tax Credits and lifelong learning credit

- IRS: Gift Tax Reporting Form 709

- IRS Publication 970

IDOR Resources:

More to explore

-

-

Contact us

Have questions about Bright Start 529? Need information for your current account? We’re here to help!

Get in contact -

Need to view your account?

Log In